With the concept of ‘Making Investing More Fun and Accessible,’ this segment introduces companies in a way that even beginners in investing can find helpful. This time, we’ll be looking at stock code [5332], TOTO.

This article provides an overview of TOTO’s business, its current metrics, and market conditions. Please read through to the end to support your own investment decisions. Note, however, that this is not a recommendation to invest, so please make any investment decisions at your own discretion.

Now, let’s dive into the main topic.

Business Overview

TOTO is Japan’s largest manufacturer of residential water-related equipment, boasting a high market share for its “Washlet” bidet systems. (Note: Although similar heated bidet seats are offered by other companies, “Washlet” is a registered trademark of TOTO.)

In addition to bidet systems, TOTO produces and sells unit bathrooms, kitchen systems, bathroom vanities, faucets, and a variety of building materials and tiles.

Performance

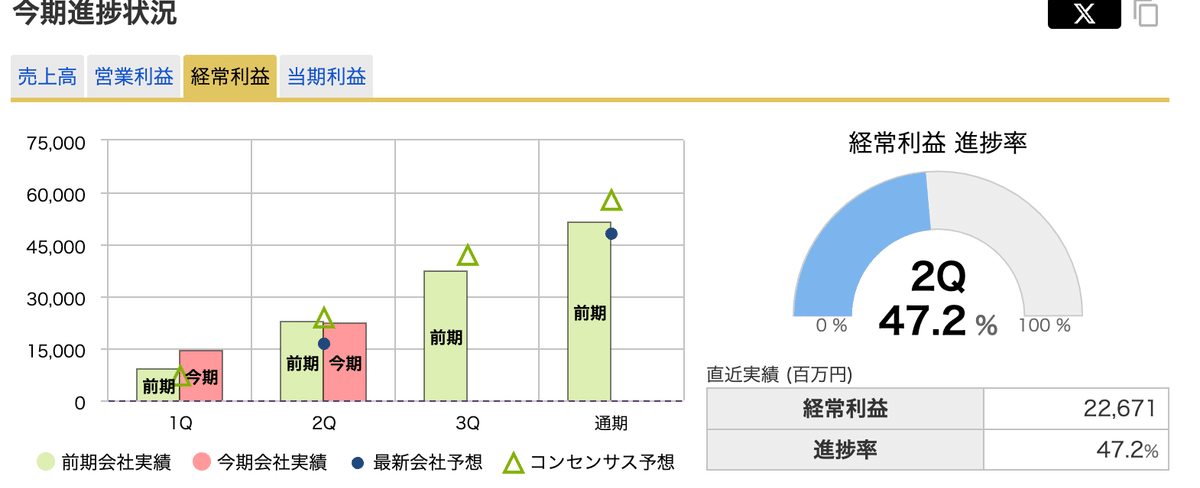

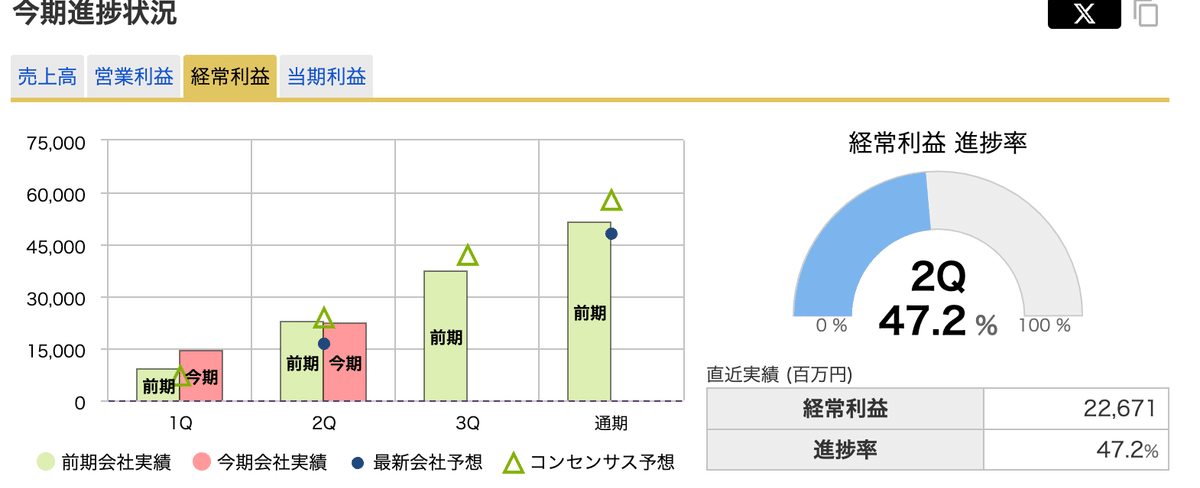

Over the past decade, TOTO’s performance has shown steady growth, with operating profit consistently on the rise.

The current profit progress rate stands at 47.2% by the end of the second quarter. However, due to a downward revision in the full-year earnings forecast, meeting this target may be challenging for the current fiscal year.

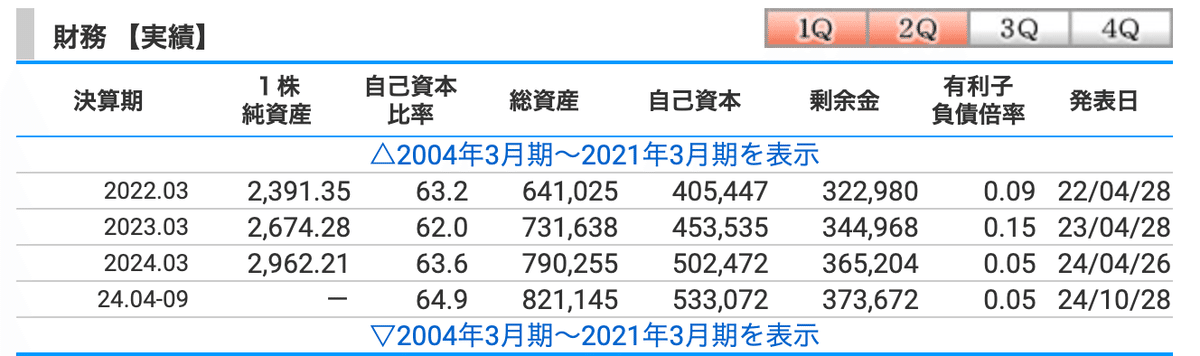

TOTO has a low interest-bearing debt ratio of 0.05 and an equity ratio of 64.9%.

For FY2024, the company’s selling, general, and administrative (SG&A) expenses amount to approximately ¥196 billion, translating to roughly ¥16.3 billion in fixed costs per month. As of the second quarter earnings announcement on October 28, TOTO holds around ¥113 billion in cash and deposits.

In the event that sales fall to zero, the company could cover fixed costs for approximately seven months. While this varies by industry, companies are generally considered financially sound if they hold cash equivalent to three to six months of fixed costs. By this measure, TOTO appears to be highly stable.

Note: While SG&A expenses do not directly represent fixed costs, they are treated as such in this note due to limitations in the financial statements.

Stock Price & Key Indicators

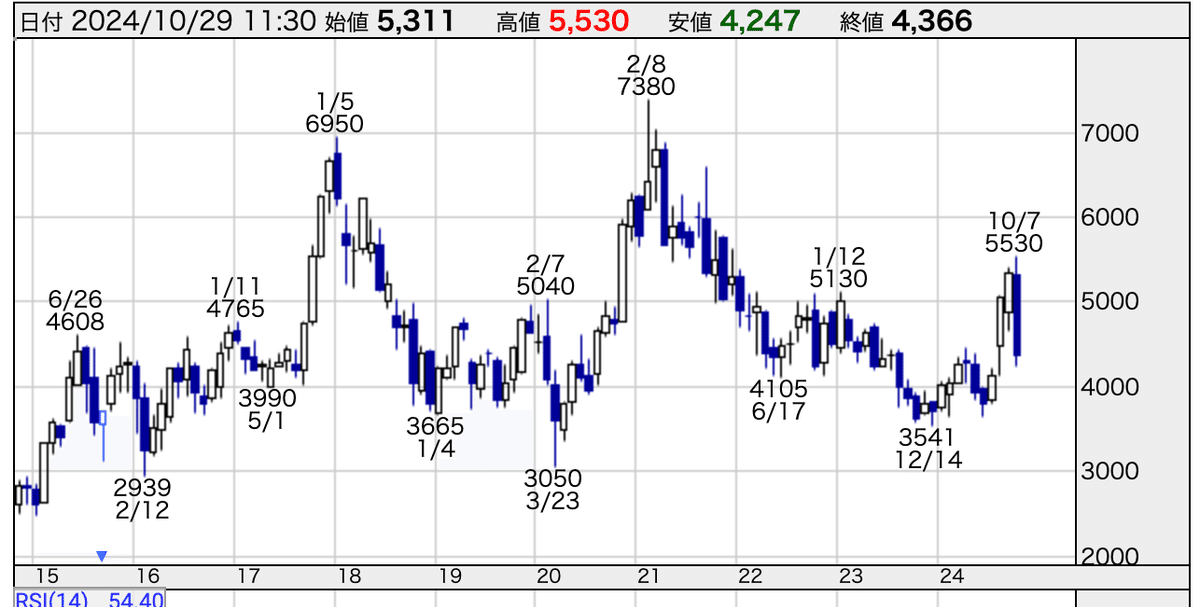

As of this article’s creation, TOTO’s stock price is ¥4,366. Over the past decade, the stock has generally fluctuated within a range of ¥3,000 to ¥7,000.

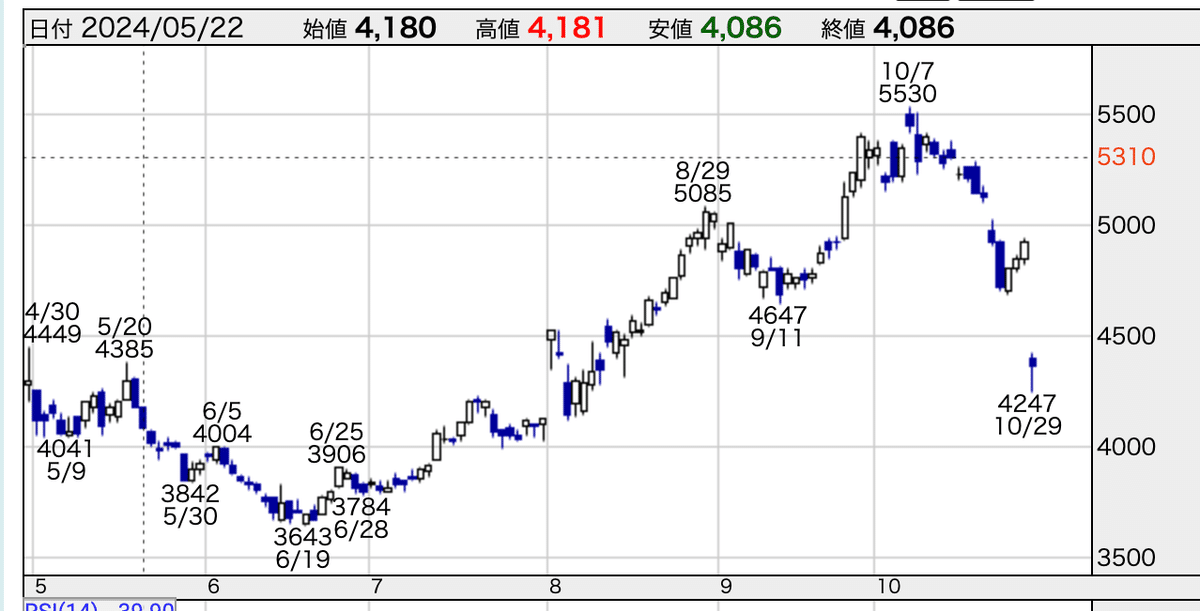

On October 28, TOTO announced a downward revision of its net profit forecast for the fiscal year ending March 2025, citing weak market conditions in China. The net profit forecast was reduced by ¥1.5 billion to ¥36 billion, representing a 3.2% decrease compared to the previous fiscal year.

Following this announcement, TOTO’s stock price plummeted, experiencing a sharp decline of around 20%, with a significant price gap opening.

The Price-to-Earnings Ratio (PER) is 20.6, and the Price-to-Book Ratio (PBR) stands at 1.39, with a market capitalization of ¥772.7 billion.

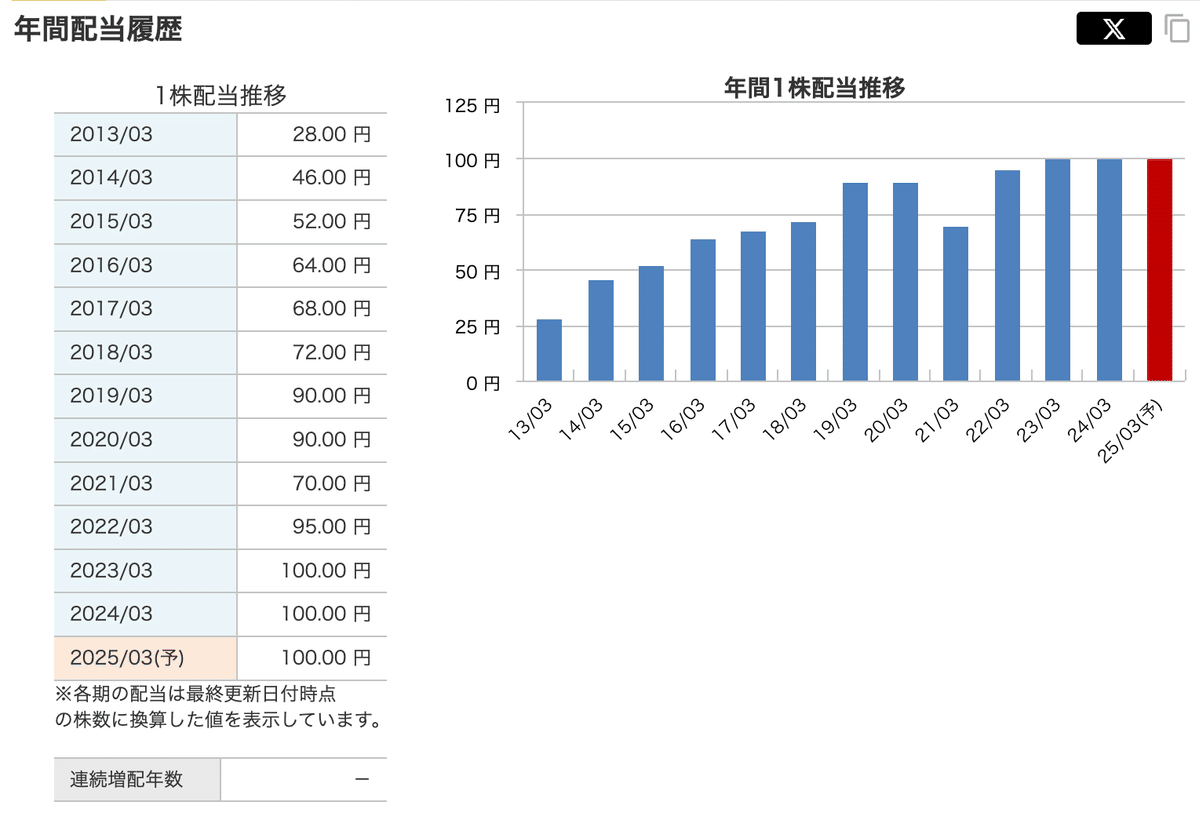

The dividend yield is 2.29%.

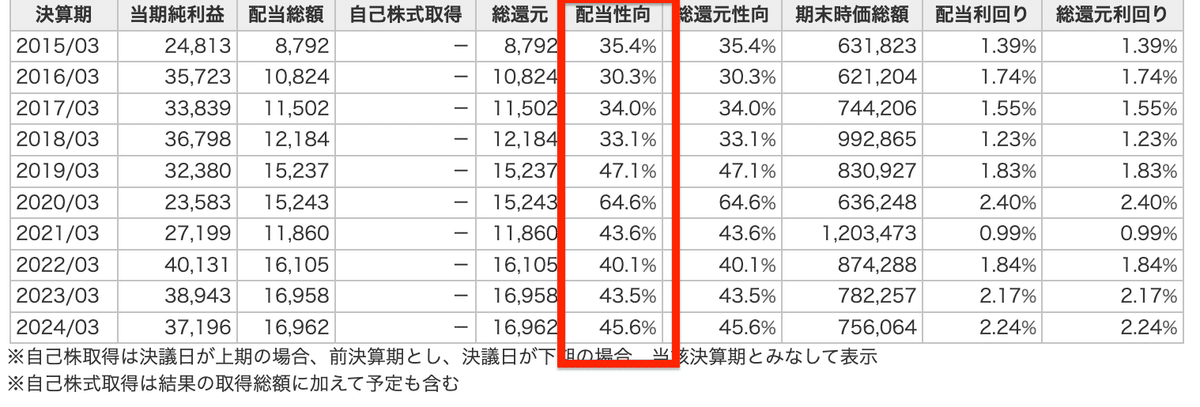

Although dividends were reduced during the COVID-19 pandemic, TOTO has otherwise maintained or occasionally increased its dividend payouts. However, with a payout ratio around 40-50% over the past decade, the capacity for further dividend increases may be limited.

Stockholder Benefits

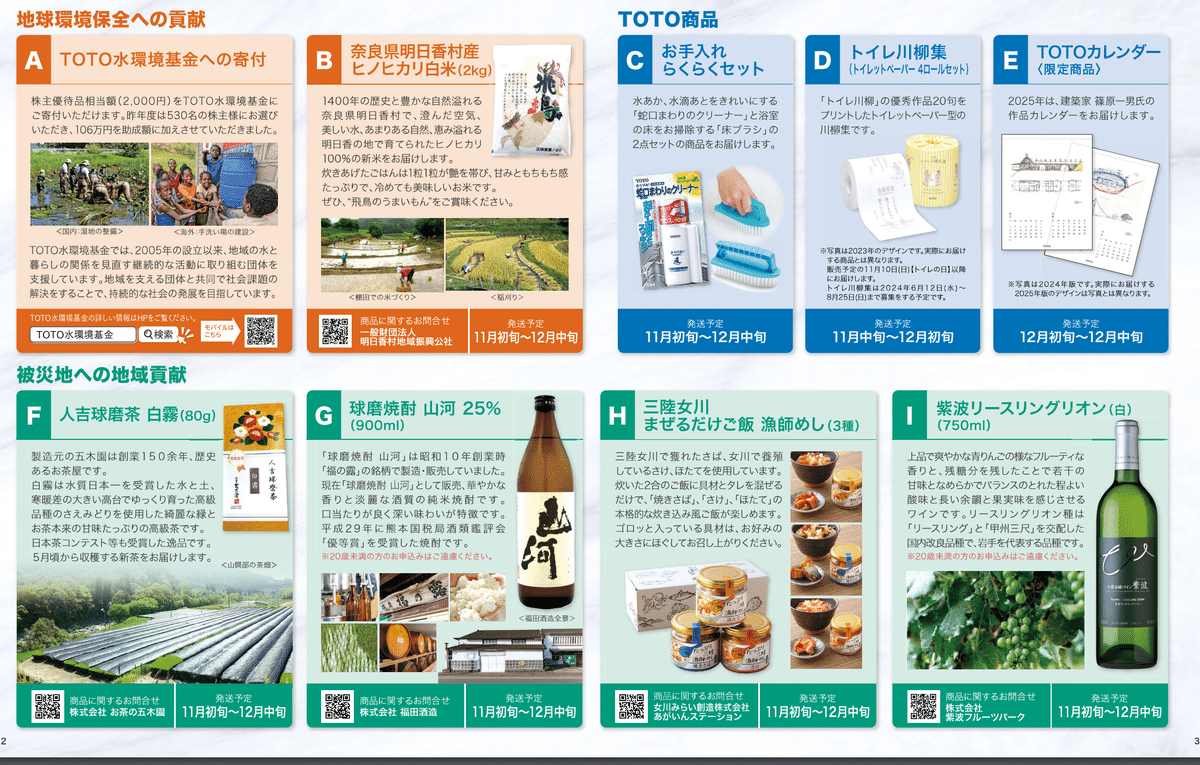

TOTO offers a stockholder benefit program for those listed on the stockholder register as holding 100 shares or more as of March 31 each year.

Eligible stockholders can choose one item from a selection of products (as shown in the image lineup).

Summary

This article covered TOTO, stock code [5332].

When investing, it’s essential to have your own perspective and make “regret-free investments” while considering even the worst-case scenarios. I encourage readers to form their own views and make investment decisions accordingly.

If you found even one helpful takeaway from this article, I’m glad to have been of assistance.

Thank you for reading until the end.